Double-Entry Bookkeeping is an accounting strategy that records a charge and credit for each budgetary exchange happening inside a company. In the Double-entry section framework, exchanges are recorded as far as charges and credits.

Since a charge in one record counterbalances a credit in another, the amount, all things considered, must rise to the amount, everything being equal.

The Double-Entry Bookkeeping of accounting normalizes the bookkeeping cycle and improves the exactness of arranged budget reports, taking into consideration improved identification of mistakes.

Double-Entry Bookkeeping Glance

Stage 1: Create an outline of records for posting your budgetary exchanges.

Stage 2: Enter all exchanges utilizing charges and credits.

Stage 3: Ensure every passage has two parts, a charge section and a credit section.

Stage 4: Check that financial reports are in adjustment and mirror the bookkeeping condition.

Double-Entry Bookkeeping

The Double-Entry technique for accounting is an arrangement of bookkeeping created throughout the hundreds of years to guarantee a legitimate and satisfactory record of budgetary exchanges.

It is the strategy that is overwhelmingly trailed by associations hoping to remove the greatest data from their business information. The Double-Entry Bookkeeping framework is intended to guarantee that all impacts of exchange are deliberately recorded and guarantees that the last records are incredibly exact.

Ostensible records are kept up, and non-money exchanges are recorded too. All the administrative systems and money related specialists consistently concur that the Double-entry passage way of accounting is the most ideal approach to keep up your books of records.

The Double-Entry Bookkeeping arrangement of accounting depends on the guideline of duality. As indicated by the guideline, every exchange causes two changes in the books of records – one in the records of credits, and one in the records of charges.

This is otherwise called the ‘rules of charge and credit’. In Double-entry section bookkeeping:

- Each credit section must have a relating charge passage and

- Each charge passage must have a relating credit section.

Bookkeeping endeavors to record the two impacts of an exchange or occasion on the element’s budget summaries. This is the use of Double-Entry Bookkeeping idea.

Without applying the Double-Entry Bookkeeping idea, bookkeeping records would just mirror a halfway perspective on the organization’s undertakings.

Envision if a substance bought a machine during a year, however, the bookkeeping records don’t show whether the machine was bought for money or using a loan.

Maybe the machine was purchased in return for another machine. Such data must be picked up from bookkeeping records if the two impacts of exchange are represented.

Customarily, the two impacts of a bookkeeping section are known as Debit (Dr) and Credit (Cr). The bookkeeping framework depends on the key that for each Debit passage, there will consistently be an equivalent Credit section. This is known as the Duality Principal.

Charge sections are ones that represent the accompanying impacts:

• Increase in resources

• Increase in cost

• Decrease in risk

• Decrease in value

• Decrease in pay

Credit sections are ones that represent the accompanying impacts:

• Decrease in resources

• Decrease in cost

• Increase in risk

• Increase in value

• Increase in pay

Double-Entry Bookkeeping is recorded in a way that the Accounting Equation is consistently in balance.

Resources – Liabilities = Capital

Any expansion in cost (Dr) will be balanced by a decline in resources (Cr) or expansion in risk or value (Cr) and the other way around. Henceforth, the bookkeeping condition will even now be in harmony.

Double-entry bookkeeping doesn’t forestall blunders totally, it restricts the impact any mistakes have on the general records. Since the records are set up to check every exchange to be certain it adjust, mistakes will be hailed to bookkeepers rapidly, before the blunder produces resulting blunders in a domino impact.

Moreover, the idea of the record structure makes it simpler to follow back through sections to discover where a mistake began.

Record Types

- At the point when you utilize Double-Entry Bookkeeping , you should utilize a few kinds of records. Some key record types include:

- Resource accounts show dollars related with things a business possesses, for example, the money in its financial records or the cost paid for its distribution center.

- Risk accounts show what the firm owes, for example, a structure contract, hardware advance, or Mastercard balances.

- Pay accounts speak to cash got, for example, deals income and premium pay.

- Business ledgers show cash spent, including bought products available to be purchased, finance costs, lease, and publicizing.

The Double-Entry Bookkeeping framework requires an outline of records, which comprises the entirety of the asset report and pay explanation accounts in which bookkeepers make sections.

A given organization can add records and tailor them to all the more explicitly mirror the organization’s activities, bookkeeping, and announcing needs.

How Double-Entry Bookkeeping function?

While you can make various record accounts physically, in case you’re taking the action to Double-entry bookkeeping, you’ll probably need to do the change to bookkeeping programming, as well. The items available today are planned with entrepreneurs, not bookkeepers, as the main priority.

There are 4 Stages in Double-Entry Bookkeeping. Four stages are explained as below :

- Stage 1: Set up a graph of records

- Stage 2: Use charges and credits for all exchanges

- Stage 3: Make sure every budgetary exchange has two segments

- Stage 4: Run your budget summaries

Stage 1: Set up a graph of records

While you can unquestionably make an outline of records physically, bookkeeping programming applications normally do this for you. When you have your outline of records set up, you can begin utilizing Double-entry passage bookkeeping.

Record types you’ll be utilizing in your diagram of records include:

- Resources: Anything you own

- Liabilities: Anything you owe

- Income/pay: What your business acquires

- Costs: The expense of working together

- Proprietor’s value: Reflects your present possession level

Stage 2: Use charges and credits for all exchanges

A charge is consistently on the left half of the record, while a credit is consistently on the correct side of the record.

A charge passage will expand the equilibrium of both resource and business ledgers, while a credit section will build the equilibrium of liabilities, income, and value accounts.

Stage 3: Make sure every budgetary exchange has two segments

When your outline of records is set up and you have an essential comprehension of charges and credits, you can begin entering your exchanges.

For instance, you overpaid your electric bill by mistake a month ago, and you get a discount of $400.00 from the electric organization.

To enter that exchange appropriately, you would need to charge (increment) your money record, and credit (decline) your utility business ledger. This can be especially significant while making a receipt or posting various cost reports for movement.

Stage 4: Run your budget summaries

It’s difficult to track down speculators or get an advance without precise fiscal reports, and it’s difficult to create exact budget summaries without utilizing Double-entry bookkeeping. By entering exchanges appropriately, your budget summaries will consistently be in balance.

In case you’re prepared to utilize Double-entry bookkeeping representing your business, you can either begin with a bookkeeping page or use the best bookkeeping software.

Double-entry Bookkeeping Examples

Under the Double-entry bookkeeping technique, each exchange is recorded in any event two records. When all exchanges are handled into the bookkeeping framework, the equilibriums of all records will be promptly accessible.

All records have a charge and a credit side. Charge implies left and credit implies right. As a result of the two-overlay or duality impact of exchanges, the complete impact on the left will consistently be equivalent to add up with the impact on the right. Consequently, the renowned line “charge rises to credit”.

Presently, here is the standard: To build a resource, you charge it; to diminish a resource, you credit it. The inverse applies to liabilities and capital.

To build an obligation or a capital record, you credit it; to diminish a risk or capital record, you charge it. Costs are charged when caused and pay is credited when acquired.

Here’s a table to summarize that :

| Accounting Element | To Increase | To Decrease |

| 1. Asset | Debit | Credit |

| 2. Liability | Credit | Debit |

| 3. Capital investment | Credit | Debit |

| 4. Capital withdrawal | Debit | Credit |

| 5. Income | Credit | Debit |

| 6. Expense | Debit | Credit |

Transactions are recorded utilizing journal entries in the journal. A journal entry is a record indicating the date of the exchange, the record/s charged, the record/s credited, their individual sums, and clarification to portray the Transactions.

Examples

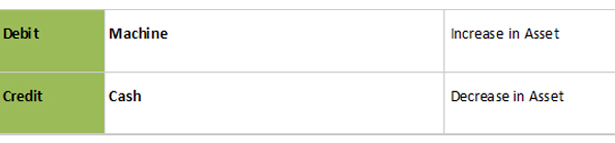

Purchase of machine by cash

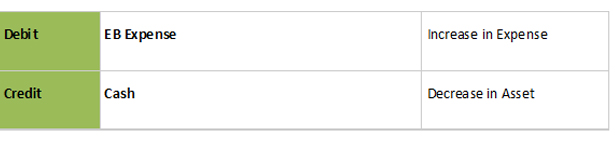

Payment of Utility Bills

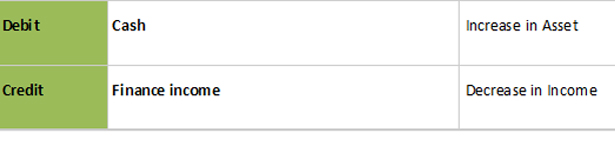

Interest received on Bank Deposit Account

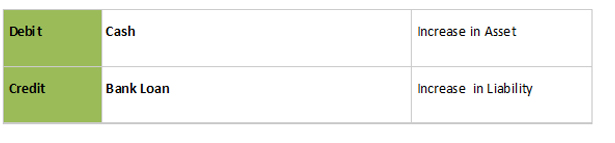

Receipt of Bank Loan Principal

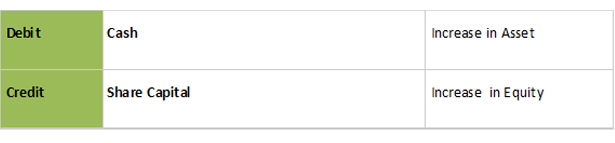

Issue of Ordinary Shares for Cash

Following are the steps to begin with Double-entry bookkeeping

- Utilize a bookkeeping page

- Use bookkeeping programming

Utilize a bookkeeping page

On the off chance that your business is tiny, you might have the option to get by utilizing a bookkeeping page application to post your money related exchanges, however accounting pages are just valuable on the off chance that you have a private company and are utilizing single-passage bookkeeping.

Use bookkeeping programming

While it’s conceivable to make a sufficient business record for your business physically, you’ll wind up investing a great deal of energy alluding to numerous record books to cause passages, to figure aggregates, and later exchange those sums to the right records to create fiscal reports.

The most ideal approach to begin with Double-entry bookkeeping is by utilizing bookkeeping programming. Numerous well-known bookkeeping programming applications, for example, QuickBooks Online, FreshBooks, and Xero offer a downloadable demo you can attempt.

All famous cloud bookkeeping software today utilize Double-entry passage bookkeeping, and they make it simple for you to begin, permitting you to get your business ready for action in an hour or less. Utilizing programming will likewise decrease blunders and dispose of out-of-balance accounts.

Benefits of Double-entry bookkeeping

More than everything else, a Double-entry bookkeeping framework, since it is the “formal” method of keeping up books of records, guarantees consistency in bookkeeping strategies, which is pivotal when settling on any choices dependent on the information from the books of records.

Records kept up under this framework are incredibly dependable, can help distinguish fakes and mistakes, and guarantee a steady and equivalent arrangement of budgetary information for the clients throughout some stretch of time and across different substances.

Most laws necessitate that few sorts of associations cling to the Double-Entry Bookkeeping technique for accounting. Consistency is one of the most pivotal things that a business should take a gander at while choosing which bookkeeping framework to utilize.

Exactness

Double-entry bookkeeping gives a more exact gander at an organization’s budgetary situation than single-section accounting. One purpose behind this is on the grounds that Double-entry bookkeeping actualizes the coordinating rule.

The coordinating rule utilizes gathering bookkeeping rules to record income and the costs identified with income. Recording both income and costs give an exact count of benefits and misfortunes.

Benefits and misfortunes are spoken to on the pay articulation, which incorporates accounts determined straightforwardly from the sections made in Double-entry bookkeeping.

Mistake Reduction

Human mistakes can cause deception of an organization’s budgetary position. Double-entry bookkeeping lessens mistakes since it gives governing rules.

With the headway of innovation, many bookkeeping programming programs consequently give Double-entry bookkeeping when an exchange is entered.

This decreases the opportunity that an exchange is presented on some unacceptable balancing account. Mistakes are effectively gotten with Double-entry bookkeeping by ensuring charge and credit sums equivalent. Despite the fact that blunders are significantly diminished with Double-entry section accounting, it doesn’t thoroughly forestall mistakes.

Leaves an Audit Trail

Double-entry section accounting lessens misrepresentation by leaving a grown-up trail. A review trail permits you to follow exchanges from the diary passages that were presented on the overall record.

For instance, if your money balance appears to be excessively high on your asset report, you can follow back the exchanges made to the money record and check whether they are exact.

You can see the specific records influenced by posting exchanges. Double-Entry Bookkeeping likewise utilizes reference numbers and furnishes brief depictions with every passage made.

Budget report Preparation

Budget summaries are effectively set up in organizations utilizing Double-entry passage accounting since data is assembled legitimately from the Double-entry section accounting exchanges.

It is significant for organizations to create exact fiscal summaries rapidly and productively. Interior clients, for example, the executives, rely upon fiscal summaries to survey where the organization is monetarily and to make operational spending plans.

Outside clients, for example, speculators and merchants, rely upon budget summaries to decide an organization’s financial soundness.