There is wonder about the contrasts between Financial Accounting and Cost Accounting. Both accounting techniques can help settle on more powerful choices as a business director.

However, Accounting is so important for numerous individuals. There are huge contrasts between the two Financial Accounting and Cost Accounting. The motivation behind both is the same, yet at the same time, there is a ton of contrast in Financial Accounting and Cost Accounting.

Financial Accounting

Financial Accounting is a part of bookkeeping that is worried about the summing up, recording, and announcing of monetary exchanges that happen in a business worry throughout a time span.

Financial accounting is utilized for the planning of different budget reports that can be utilized by organizations to grandstand their budgetary exhibition to the different clients of money related data like leasers, speculators, clients and providers, and so forth.

Planning of budget summary is the significant goal of money related bookkeeping in a predefined way for a specific bookkeeping time of an element.

It incorporates Income Statement, Balance Sheet, and Cash Flow Statement which helps in, following out the presentation, productivity and budgetary status of an association during a period.

It orders, stores, records, and breaks down an organization’s fiscal reports. The objective is to improve the business’ productivity and increment its straightforwardness. Financial Accounting presents a precise money related image of an organization to the partners.

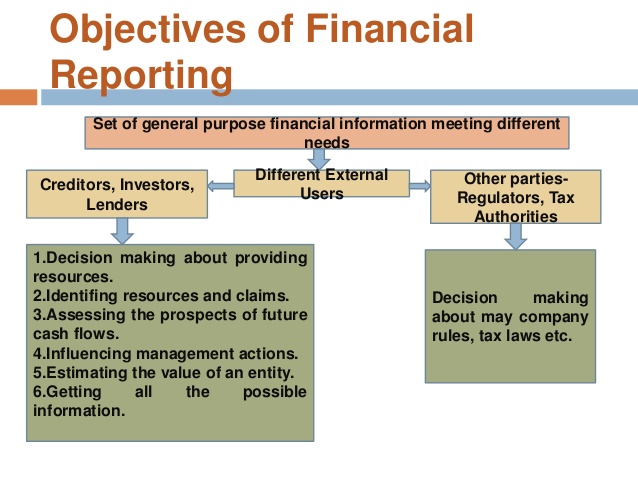

Goals of Financial Accounting

The budget summaries have various purposes and give data to investors and advance banks to improve venture revenue. Barely any different goals are:

- Orderly Recording Of Financial Transactions

- Uncovering The Financial Position Of The Firm

- Finding out The Result Of Business Operations

- Announcing Past Performance And Future Prospect

Focal points -The Financial reports head orders are incomes, costs, value, resources, and liabilities. Not many points of interest in budgetary bookkeeping are:

Upkeep of Business Record-All the subtleties of the exchange are recorded in the book of record deliberately.

Arrangement of Financial Statements-All the records help the bookkeeper to set up a money-related report of the organization and check the monetary status.

Correlation of Result-The Financial report mirrors the benefits of the organization which can be utilized to check the earlier year’s Financial status.

Go about as Legal Evidence-It some of the time it goes about as proof for a couple of cases.

Lift Leanders-The assertion gives expected data to the cash banks so they raise the credits.

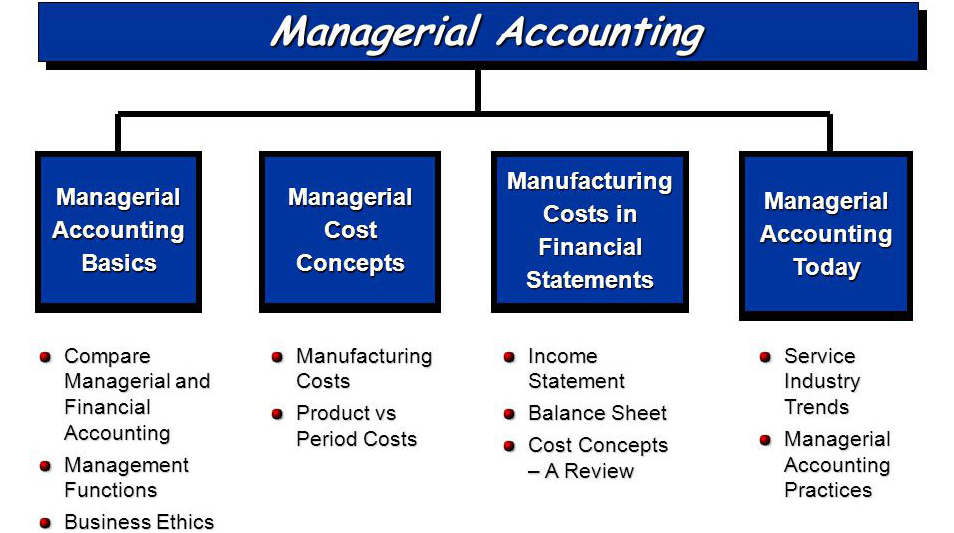

Cost accounting

Cost accounting applies costing strategies and methods to lessen business costs. Its principle objective is to compute the expense per unit of your business’ items or cycles.

Cost accounting is alluded to as a type of administrative bookkeeping that is utilized by organizations to order, sum up and investigate the various expenses with the end goal of cost control and cost decrease and accordingly helping the board in settling on better choices.

The essential capacity of cost bookkeeping is supposed to organize, recording, and recognizing reasonable speculation distribution for the venture to decide the expenses of products and enterprises.

It likewise helps in introducing applicable information to the administration identified with administration, agreement, or discovering shipment cost. It additionally incorporates data identified with the cost of creation, dispersion, and selling.

Cost bookkeeping produces data in order to keep a mind activities, with a point of augmenting benefit and proficiency of the worry. Alternately, Financial bookkeeping determines the budgetary outcomes, for the bookkeeping time frame and the situation of the resources and liabilities on the most recent day of the period.

There is no correlation between these two Financial Accounting and Cost Accounting since they are similarly significant for the clients. This article presents you with the distinction between cost bookkeeping and budgetary bookkeeping in plain structure.

Cost Accounting adds to the adequacy of the money related bookkeeping by giving significant data which eventually brings about the great dynamic cycle of the association.

It follows the expense brought about at each degree of creation, for example directly from the contribution of the material till the yield delivered, every single expense is recorded. There are two kinds of Cost Accounting frameworks, they are:

- Non – Integrated Accounting System

- Incorporated Accounting System

Non – Integrated Accounting System: The bookkeeping framework in which separate arrangement of books is kept up for cost data.

Incorporated Accounting System: The bookkeeping framework in which cost and budgetary information are kept up in a solitary arrangement of books.

Goals of Cost Accounting

Cost bookkeeping is an apparatus that can decide the bookkeeping and costing strategies and systems to learn the expense. Hardly any targets are referenced underneath:

- To decide per unit cost of different products delivered by a business

- To introduce a precise report of both activity and cycle cost

- To demonstrate and readies a report for the wastage costs as far as crude material, time or cash utilized in apparatus

- To give significant information and rules to deciding the expense of produced merchandise or administrations delivered

- To comprehend the benefit of each item created and educate the board about how benefits can be augmented.

Preferences of Cost Accounting?

Cost bookkeeping is the way toward gathering and assessing data to find how an association can boost its procuring and use reserves. There are different focal points of cost bookkeeping.

Here are a couple of key favorable circumstances to think about cost bookkeeping:

Cost object examination Expenses and incomes can be accumulated by cost object, similar to product offering, dispersion channel, and side-effect to comprehend which is viable or need extra help.

Finds causes-It finds issues inside a firm and learns the particular reason for the issue, moreover recommends answers for the administration.

Pattern investigation – It can follow a pattern line to discover the cost floods

Decide Cost-It can be utilized in different degrees of action. For example, if the executives are searching for a subsequent move, cost bookkeeping can expect the additional costs connected with the subsequent move.

Limit – The limit of a business to support improved deals levels can be dictated by looking at the estimation of its overabundance limit.

Key Differences Between Financial Accounting and Cost Accounting

Cost Accounting is a bookkeeping framework through which an association monitors various expenses brought about underway activities in the organization.

Financial Accounting is a bookkeeping framework that gathers records of organization monetary data to exhibit the organization’s precise money related situation at a particular date.

Coming up next are the significant contrasts between Financial Accounting and Cost Accounting:

Cost Accounting targets keeping up cost records of an association. Monetary Accounting targets keeping up all the money related information of an association.

Cost Accounting Records both authentic and per-decided expenses. Alternately, Financial Accounting records just authentic expenses.

Clients of Cost Accounting is restricted to inner administration of the substance, though clients of Financial Accounting are interior just as outside gatherings.

In cost, bookkeeping stock is esteemed at cost while in Financial bookkeeping, the stock is esteemed at the lower of the two for example cost or net feasible worth.

Cost Accounting is compulsory just for the association which is occupied with assembling and creation exercises. Then again, Financial Accounting is required for all the associations, just as consistence with the arrangements of Companies Act and Income Tax Act is additionally an absolute necessity.

Cost Accounting data is accounted for occasionally at successive stretches, however monetary bookkeeping data is accounted for after the consummation of the money-related year for example for the most part one year.

Cost Accounting data decides benefit identified with a specific item, work or cycle. Instead of Financial Accounting, which decides the benefit for the entire association made during a specific period.

Financial accounting targets discovering aftereffects of bookkeeping year as Profit and Loss Account and Balance Sheet.

Cost Accounting targets figuring the cost of creation/administration in a logical way and encourage cost control and cost decrease.

Financial accounting reports the outcomes and position of business to government, lenders, speculators, and outside gatherings.

Cost Accounting is an inward announcing framework for an association’s own administration for dynamic. In Cost accounting, cost characterization dependent on the kind of exchanges, for example, pay rates, fixes, protection, stores, and so on.

In cost bookkeeping, characterization is fundamentally based on capacities, exercises, items, measures, and inward arranging and control and data needs of the association.

Financial accounting targets introducing a valid and reasonable’ perspective on exchanges, benefits, and misfortune for a period and a Statement of monetary position (Balance Sheet) on a given date. It targets figuring ‘valid and reasonable’ perspective on the expense of creation/administrations offered by the firm.

The motivation behind Financial Accounting and Cost Accounting is to control costs, yet the reason for Financial bookkeeping is to keep total records of the money related data, based on which revealing should be possible toward the finish of the Financial Accounting and Cost Accounting time frame.

Financial Accounting and Cost Accounting Sort of cost

The sort of cost in Financial Accounting and Cost Accounting are :

Cost Accounting Recorded just as pre-decide

Financial Accounting It is Just authentic expense.

Financial Accounting and Cost Accounting Required

Cost Accounting : No, it isn’t required, aside from assembling firms.

Financial Accounting : It is compulsory for all organizations.

Financial Accounting and Cost Accounting Forecasting

In Cost Accounting, with the assistance of planning methods determining, is conceivable.

In Financial Accounting, anticipating is preposterous.

Financial Accounting and Cost Accounting Purpose

The motivation behind cost bookkeeping is controlling and lessening costs.

The motivation behind Financial Accounting is to keep the whole record of the monetary exchanges.

Financial Accounting and Cost Accounting Benefit Analysis

In cost bookkeeping, typically, the benefit is dissected for a particular work, group, item, measure, and so forth

In Financial bookkeeping, consumption, benefit and pay are dissected all the while for a particular time of the whole unit.

Financial Accounting and Cost Accounting Users

Cost Accounting data is just utilized by the association’s inner administration, for example, chefs, workers, directors, supervisors, and so on.

Financial Accounting data is utilized by inward and outer gatherings, for example, clients, leasers, investors, and so forth.

Conclusion

Both Financial Accounting and Cost Accounting perform indispensable capacities for a business. The two sorts of bookkeeping can assist with overseeing danger and increment comprehension of the funds of a business and how to improve them. Eventually, the two sorts of bookkeepers are fundamental for the continued wellbeing of an association.