Everybody utilizes bookkeeping somehow or another. People use bookkeeping techniques to keep up their own spending plans, accommodate their month to month charge card bills, and equilibrium their checkbooks.

Each business from a sole owner to an enormous global organization – utilizes bookkeeping strategies to follow incomes and expenses and break down monetary information. In spite of the fact that the size and extent of their bookkeeping divisions may vary, all must record exchanges.

The accounting can be seen as the establishment of any association that necessities to oversee holds. Consequently, it accepts a basic capacity in every business.

An accounting office is major for any relationship to achieve cost-reasonability in its finances. Following basic accounting norms is fundamental for accomplishment in any size business; quick record-keeping and budgetary examination are basic to check your expenses, yet to finding new streets of advancement.

Why accounting is so important?

Direct accounting writing computer programs is critical for following the achievement of your business. It licenses customers to store all the information that gives an away from of the business budgetary prosperity.

The item can without a doubt administer bookkeeping and grants noticing costs and livelihoods to enhance generally speaking incomes. Work zone set up accounting writing computer programs is acquainted with deference with PCs that perform basic accounting tasks with no issue.

It is sensible for minimal estimated associations. It can sufficiently direct and screen your business. Here are some reasons why accounting is important.

- Accounting keeps you coordinated

- It backs up your expense form claims

- Bookkeeping considers you responsible

- It guides dynamic

- You can gauge new methodologies with hard numbers

- It’s fundamental for getting speculations or advances

- Simple to utilize

- Assistants in surveying the presentation of business

- Helps with directing and screen pay

- Urges business to be lawful pleasant

- Helps with making budgetary arrangement and future projections

- Assistants in archiving spending reports with regulators, stock exchanges, and recording of government structures

Accounting keeps you coordinated

Why is bookkeeping significant, you inquire? Without bookkeeping, you wouldn’t know how much cash your business has acquired. You could undoubtedly fail to remember how much cash you paid out. Furthermore, you wouldn’t recall how your present benefit or misfortune contrasted with the past quarters.

Which clients haven’t paid you? Stand by, what obligations haven’t you paid at this point? On the off chance that you use gathering bookkeeping, you (should) realize precisely how much your records receivable and payable are.

So, bookkeeping shows you precisely what your business has been up to with regards to funds. It keeps you coordinated so you can precisely and legitimately round out your expense form, which we’ll discuss straightaway

It backs up your expense form claims

Numerous entrepreneurs fear private company charge documenting, particularly in the event that they have no clue about where to begin. Here’s the place where the significance of bookkeeping in business comes in.

Stage one of documenting your expense form is gathering budgetary records. Without these records (e.g., budget reports), you won’t have the option to enter the right numbers onto your return.

But since we addressed this above, we will jump into the second piece of bookkeeping and rounding out expense forms: the feared review. On the off chance that you get examined by IRS, what occurs?

You have to show them that you’ve done your due perseverance and have the essential bookkeeping information to back up your return.

Accounting considers you responsible

In the event that you have investors in your independent venture, you realize that it is so imperative to show as opposed to tell. Bookkeeping does exactly that.

Your investors consider you responsible for the achievement of your business. They can notice your business’ development and accomplishment by taking a gander at your bookkeeping records. On another note, bookkeeping can likewise assist you with considering your representatives responsible.

Stay up with the latest on things like accommodating bank articulations and performing preliminary adjusts. That way, you can get deceitful action before it takes an over the top cost for your business.

It guides dynamic

Would it be a good idea for you to purchase that fresh out of the plastic new, best in class printer for the workplace? All things considered, that relies upon whether you can manage the cost of it.

Alright, what about your costs? Is there anything you have to slice to support your business’ main concern? That relies upon the amount you’re spending and on what.

To address addresses like these, you have to take a gander at information—your bookkeeping records, to be precise. Bookkeeping can help direct the choices you commit so you dodge basic business errors, as:

- Overspending

- Underspending

- Leveling

You can gauge new methodologies with hard numbers

Before you roll out an improvement in your business, you probably direct a danger examination for private venture. That way, you can decide if facing that challenge could profit or harm your business.

However, shouldn’t something be said about after the danger? Don’t you need to investigate the impacts of facing a challenge (i.e., rolling out an improvement) after you do it?

Bookkeeping can help. You have the numbers demonstrating your operational expense’s and income before the change. Furthermore, after you roll out the improvement, you can think about the numbers. That way, you know whether your procedure aided or hurt your business.

It’s fundamental for getting speculations or advances

Speculators and banks need to become familiar with a tad about you before they put away or loan you cash. Also, that implies sticking and nudging into your business’ bookkeeping books.

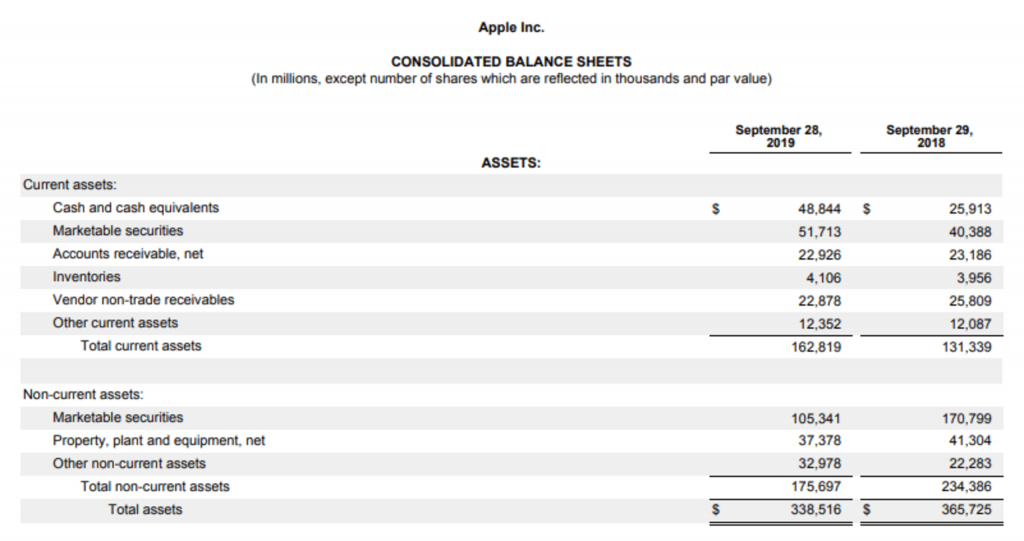

For the most part, you should show speculators and moneylenders your business’ budget reports. That way, they can acquire data about your productivity.

Without coordinated bookkeeping books, your budget summaries, budgetary figures, and productivity claims won’t be exact or have any sponsorship.

Simple to utilize

Accounting associations make programming recollecting the standard customer, as needs be, people with no accounting data can keep up genuine bookkeeping with straightforward accounting programming.

It performs accounting tasks quickly that puts aside time and money. It similarly allows the capable organization of information and record with no issue.

Assistants in surveying the presentation of business

As inspected over, the accounting records reflect the outcomes of errands similarly to the announcement of financial position.

Moreover, unique resource report and advantage and hardship accounts extents are resolved which help customer of monetary outlines to examine the introduction of a substance. For example commitment esteem extent, Current extent, Turnover extent, etc.

Helps with directing and screen pay

The working capital and cash need of an endeavor can be suitably taken thought by a real accounting structure.

Urges business to be lawful pleasant

Real business accounting ensures helpful records of our liabilities which ought to be paid inside the embraced plan. This fuses helpful resources, annuity hold, VAT, bargains charge, Income charge. The ideal portion of liabilities urges dares to be legitimate reliable.

Helps with making budgetary arrangement and future projections

Accounting data urges a dare to design budgetary arrangement and check for future period. Business designs are expanded reliant on past data made by accounting system.

Assistants in archiving spending reports with regulators, stock exchanges, and recording of government structures. Tries are expected to archive the spending reports with ROC. In the case of recorded components, the identical is should have been reported with stock exchanges as well.

For both abnormal and direct evaluation recording purposes, financial reports and other budgetary information are required.

Other important things about accounting

The accounting system gives different quantitative altered reports which are required in ordinary business works out.

- Make Reports

- Improve Financial Performance

- GST Ready Feature

- Accuracy and Speed

Make Reports

Accounting programming grants making reports that show overall financial status of the association. It gives survey trail reports and sends them in Excel plan.

Improve Financial Performance

Accounting programming gives encounters of commonly financial execution of the business. It handles all budgetary pieces of your association and keeps the record of business trades.

It supervises general records, cash due, and bank liabilities. Furthermore, it grants the following pay, pay, and expenses.

GST Ready Feature

It is incredibly difficult to discover GST actually for associations. Accounting programming immensely helps associations in performing accounting tasks.

GST arranged part of direct accounting programming gives exact calculations of GST. It helps in GST bargain and following basically a tick. It revives a data informational collection on GST.

Accuracy and Speed

Presumably, the best bit of leeway of accounting writing computer programs is a more huge degree of precision and speed. It gives continuous data that helps in streamlining business trades.

Accountant Jobs and Responsibilities

In spite of the fact that the day by day obligations of a bookkeeper will shift by position and association, the absolute most regular assignments and duties of bookkeepers include:

- Guaranteeing the exactness of monetary archives, just as their consistence with applicable laws and guidelines

- Planning and keeping up significant monetary reports

- Planning government forms and guaranteeing that expenses are paid appropriately and on schedule

- Assessing money related activities to suggest best-rehearses, recognize issues and plan arrangements, and assist associations with running effectively

- Offering direction on cost decrease, income improvement, and benefit boost

- Leading anticipating and danger examination evaluations

Furthermore, bookkeepers have a lawful commitment to act genuinely and evade carelessness in their practices. Accordingly, they are likewise liable for guaranteeing that their customers’ budgetary records are agreeable with the applicable laws and guidelines.

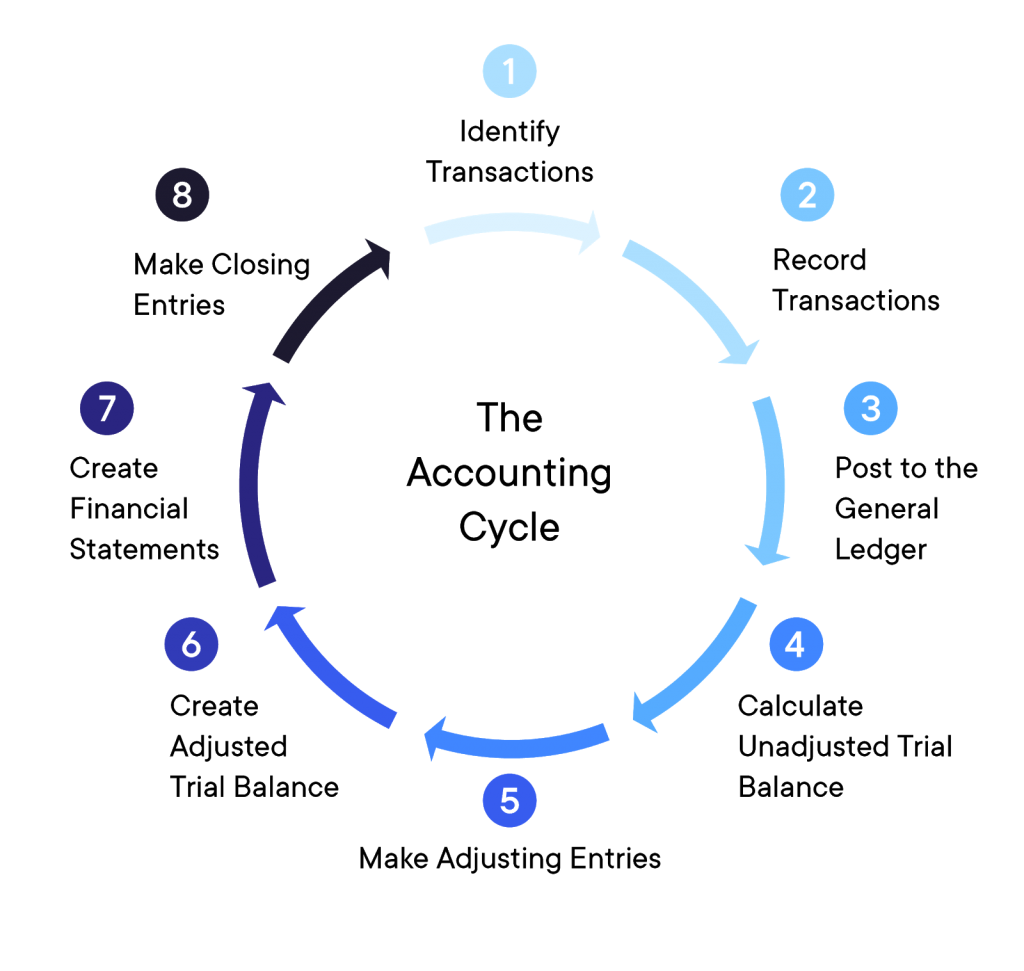

Accounting Cycle

The accounting cycle is the thorough pattern of recording and dealing with all budgetary trades of an association, from when the trade occurs, to its depiction on the financial reports, to closing the records.

One of the rule commitments of an agent is to screen the full accounting cycle from start to finish. The cycle reiterates itself each money related year up to an association remains in business.

For the most part, there are eight phases in accounting cycle measures. In any case, you can add or remove certain methods when indispensable. Use the implies that help you with staying facilitated and keep up careful records. There are 8 Phases in the accounting cycle.

Eight phases of accounting Cycle

- Perceive trades

- Record trades in your journal

- Post segments to the general record

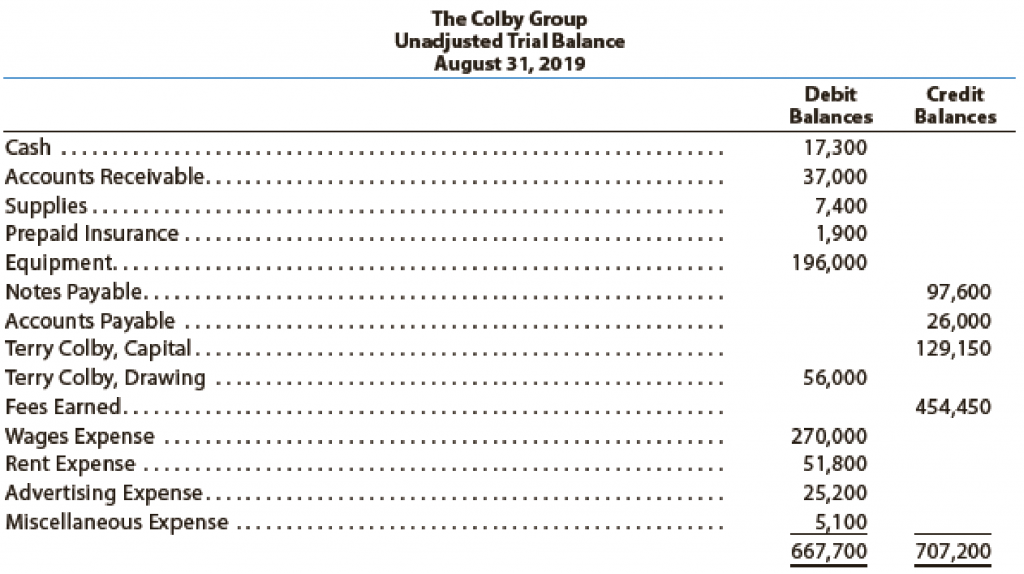

- Unadjusted starter harmony

- Changing entries

- Changed primer harmony

- Make spending rundowns

- Closing the Books

1.Perceive trades

The initial phase in the bookkeeping cycle is recognizing exchanges. Organizations will have numerous exchanges all through the bookkeeping cycle. Everyone should be appropriately recorded on the organization’s books.

Recordkeeping is fundamental for recording a wide range of exchanges. Numerous organizations will utilize retail location innovation connected with their books to record deals exchanges. Past deals, there are likewise expenses that can come in numerous assortments.

2. Record trades in your journal

The second step in the cycle is the formation of diary sections for every exchange. Retail location innovation can assist with consolidating Steps 1 and 2, yet organizations should likewise follow their costs.

The decision among the gathering and money bookkeeping will direct when exchanges are formally recorded. Remember, accumulation bookkeeping requires the coordinating of incomes with costs so both must be reserved at the hour of the offer.

Money bookkeeping expects exchanges to be recorded when money is either gotten or paid. Twofold section accounting calls for recording two passages with every exchange to deal with an altogether evolved asset report alongside a pay explanation and income articulation.

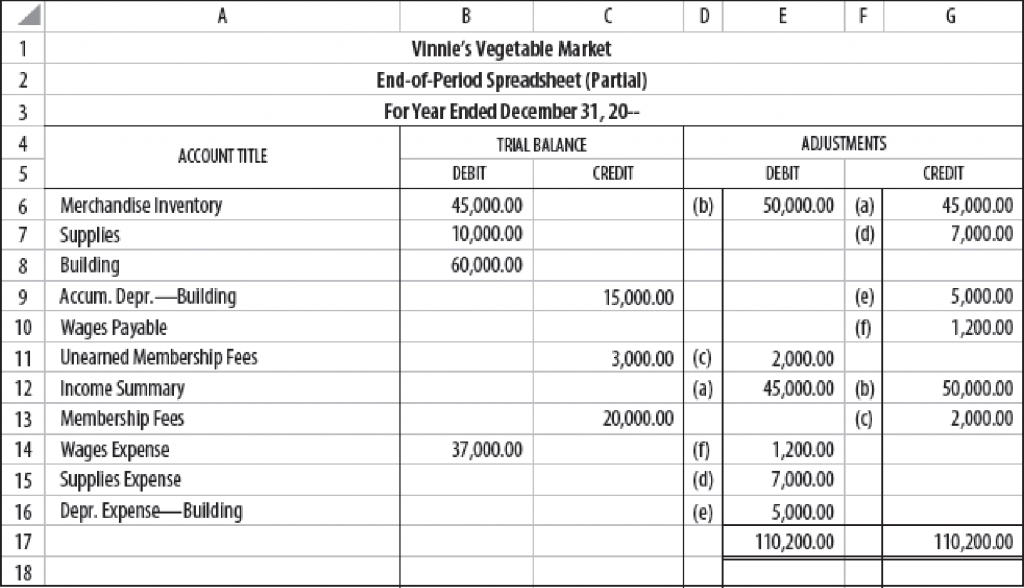

3. Post segments to the general record

Once an exchange is recorded as a diary passage, it should post to a record in the overall record. The overall record gives a breakdown of all bookkeeping exercises by account.

This permits a clerk to screen monetary positions and statuses by account. One of the most normally referred to accounts in the overall record is the money account which subtleties how much money is accessible.

4. Unadjusted trial balance

At the finish of the bookkeeping time frame, a preliminary equilibrium is determined as the fourth step in the bookkeeping cycle.

A preliminary equilibrium tells the organization its unadjusted equilibriums in each record. The unadjusted preliminary equilibrium is then conveyed forward to the fifth step for testing and examination.

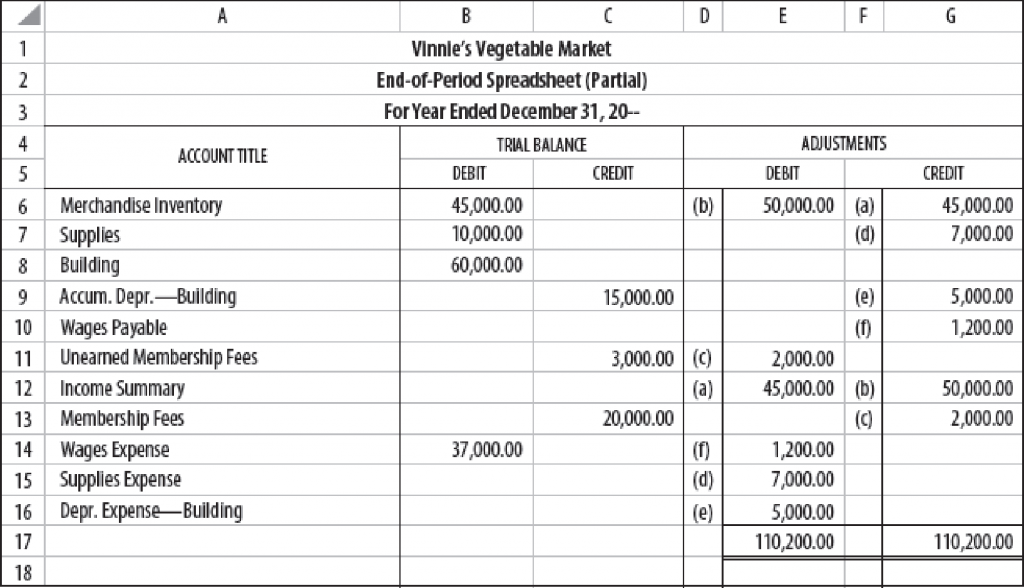

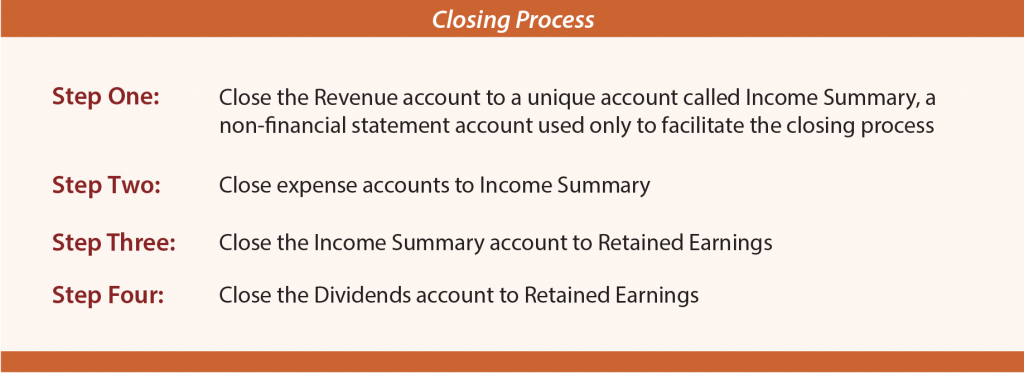

5. Adjusting entries

Examining a worksheet and distinguishing changing sections make up the fifth step in the cycle. A worksheet is made and used to guarantee that charges and credits are equivalent. On the off chance that there are errors, at that point changes should be made.

Notwithstanding distinguishing any blunders, changing sections might be required for income and cost coordinating when utilizing accumulation bookkeeping.

6. Changed adjusted entries

In the 6th step, a clerk makes changes. Changes are recorded as journal entries where important.

7. Make spending rundowns

After the organization makes all changing passages, it at that point creates its budget summaries in the seventh step. For most organizations, these assertions will incorporate a pay proclamation, asset report, and income explanation.

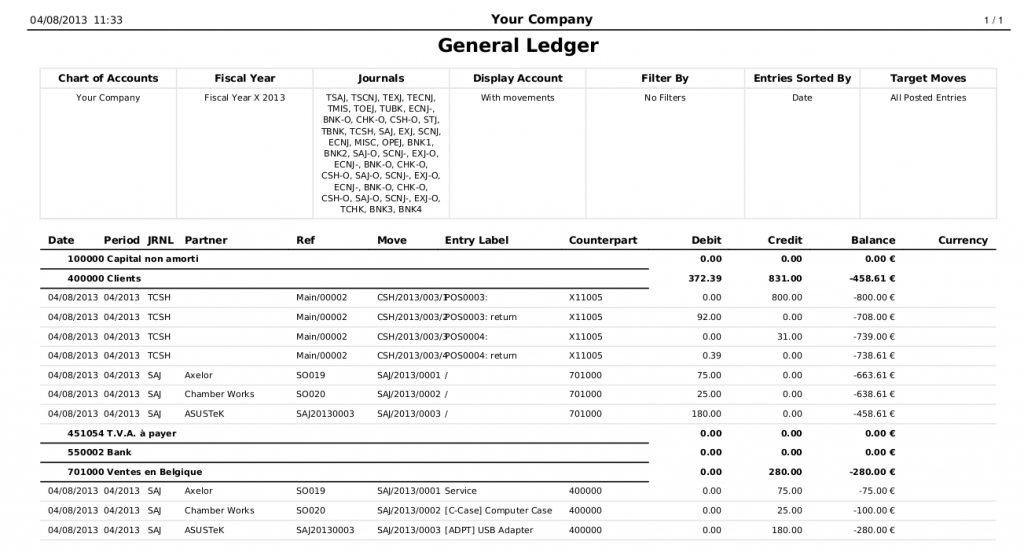

8. Closing the Books

Finally, an organization closes the bookkeeping cycle in the eighth step by shutting its books by the day’s end on the predefined shutting date. The end explanations give a report to the investigation of execution over the period.

Required Significant Skills in Accounting

There are a few aptitudes that all bookkeepers require to be fruitful in their jobs. The absolute most significant aptitudes for bookkeepers are:

Scrupulousness

Accounting experts must give solid consideration to detail to have the option to keep data precise and coordinated.

With the measure of monetary information that must be investigated, it tends to be anything but difficult to commit errors; nonetheless, straightforward mistakes can convert into a lot bigger issues in the event that they are not gotten.

Business sharpness

To be viable in this job, a bookkeeper must comprehend the essential elements of a business to precisely dissect and decipher money related information. Having a strong establishment in business gives setting to the monetary data that bookkeepers work with consistently.

PC education

Professionals in this field should have the option to utilize progressed bookkeeping programming and other PC based apparatuses to work adequately.

Explanatory abilities

Collecting and dissecting money related information is a huge piece of bookkeeping and is a significant part of recognizing examples and likely issues.

Truth be told, applying information examination to the bookkeeping field is an arising pattern in the business that is relied upon to have a developing effect later on.

Relational abilities

Accountants must have the option to listen cautiously to precisely accumulate raw numbers from customers, supervisors, or different partners.

They should likewise have the option to obviously explain the consequences of their work and present their discoveries in composed reports.

Numerical abilities

A typical confusion is that you must be acceptable at math to be a bookkeeper.

The facts confirm that numerical aptitudes are significant to break down, look at, and decipher information and figures; nonetheless, complex numerical abilities are not commonly important to turn into a bookkeeper.

Variables to Consider in Choosing an Accounting Software

Bookkeeping arrangements are helpful and critical for your business. That is the reason it’s essential to be cautious in picking which one to execute with the wide exhibit of choices accessible these days.

There is nobody ‘size fits all’ answer for your own business, yet becoming acquainted with your requirements through business assessment and monitoring fundamental variables to consider for the product is basic.

You ought to likewise consider how much Accounting software costs. Here are a few instances of things to remember while picking an answer:

Highlights

From your assessment, ideally with the assistance of a bookkeeper, check whether the item’s highlights coordinate with your necessities since programming arrangements are not made equivalent.

Generally esteem

The least expensive choice isn’t generally the best. Consider the product’s general worth dependent on its arrangement of highlights and functionalities.

Adaptability

Development is one of any business’ objectives; thus, factor in scaling to guarantee the product will develop with you as your requirements become all the more requesting.

Expectation to absorb information

Mull over what amount of time it will require to gain proficiency with the product. Picking one that is easy to understand is basic to promptly actualize the framework.

Incorporations

Augmenting what you can do in the product is accomplished with a hearty commercial center of incorporations that will upgrade the framework’s usefulness and center abilities.

Its an obvious fact that entrepreneurs have a great deal to do. As we’ve investigated here, the monetary ramifications of business possession are broad, yet basic to an organization’s prosperity.

Having a reliable, proficient bookkeeping framework can save your chance to zero in on the things you love about your business. As you investigate the best Accounting software for your organization, think about the accompanying inquiries:

- What is the size of my organization? Independent companies by and large have less than 20 representatives.

- What innovation is accessible to me and my workers?

- Is my comprehension of fundamental bookkeeping capable?

- Does my income consider bookkeeping consumptions on a month to month or yearly premise?

- How agreeable am I giving over delicate business information to an individual or bookkeeping administration?

- Is every day information passage something that I or one of my staff can sensibly achieve?

- Does my organization work in an unpredictable duty climate that might be liable to review?

- Do my rivals in the business discover a specific strategy to be generally valuable?

- Are there similarity elements to consider with other innovative cycles that routinely happen, similar to finance?

The appropriate responses you decide will assist you with choosing which alternatives bode well for you and your business. At that point, you can return to doing what you love with trust in your budgetary future.